by Portia S.

The thought of health insurance often makes people extremely frustrated and overwhelmed. With so many different types of insurance to choose from, it can be difficult picking which insurance option is best for you, especially when your insurance decisions not only affect you but potentially your entire family as well.

Health insurance is important for everyone, and can ultimately save you money. Below are several scenarios that many people have seen themselves in.

See which lifestyle description fits you to find out which supplemental health insurance option is best for you, your family, and your wallet.

Scenario 1: Accident Insurance for Active Families

Who You Are

You are a parent with very active children and an active lifestyle yourself.

Your child has a favorite sport, one that is not necessarily accident-free.

Your children’s friends and teammates are constantly injured.

It’s only a matter of time before your child gets injured while playing their beloved sport.

Your health insurance might cover a trip to the emergency room, hospital bills or office visits, but you may be on your own when it comes to these and other bills.

You may also need extra cash if you have to take time off work to care for your child.

Insurance You May Need: Accident Insurance

Accident coverage can help you and your family deal with expenses related to unexpected injuries. Accidental injuries such as broken bones, burns, breaking a tooth while playing sports, torn or pulled muscles can happen to anyone.

Health insurance may help you with doctor or hospital visits, but you may have other expenses to worry about, including transportation to get to and from your doctor’s appointments, crutches, or physical therapy.

There are also costs associated with the follow-up visits. That is where accident insurance comes in.

How It Works?

With accident insurance, you get a cash benefit for the dollar amount of the medical and recovery expenses resulting from a covered accidental injury, even if your health insurance paid for those expenses!

You will be able to spend the money you receive the way you want, or pay for the expenses your health insurance might not cover.

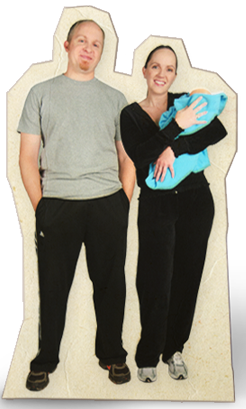

Scenario 2: Term life Insurance for Couples

Who You Are

You’re a young, healthy and active couple. You and your spouse both have stable jobs, but you could definitely use a pay raise. Now you and your spouse are expecting your first child soon, which will make your budget a lot tighter.

You are beginning to research the proper steps to make sure your child and family is protected and financially secure at all times.

With 2 incomes your family budget is extremely limited, so you begin to imagine what it would be like to take care of all of your bills if your family only had one source income. It’s a scary thought.

Insurance You May Need: Term Life Insurance

You know the saying: Nothing is certain but death and taxes. Even though we don’t like thinking about it, some planning can give you more peace of mind to help take the financial burden off your loved ones. A life insurance policy can help your family maintain their lifestyle.

How It Works?

You will pay a premium amount and in the event of your death, a benefit will be paid to whomever you’d like. Generally, you want to make sure current and future debts and expenses are covered and that enough money is left over for your family to maintain their lifestyle.

Scenario 3: Disability Insurance for Hard Working Employees

Who You Are

You are a hard worker who has had a job practically all your life and have never had an accident while on the job. Recently, you have heard about a friend who had an unexpected accident while on the job and is now struggling to pay their bills.

This has prompted you to think about the possibility of you being in a freak accident yourself and how long you could maintain your lifestyle if you were unable to work.

Health insurance can help pay for the doctor and treatments, but your other expenses will not be taken care of since you will not be receiving a normal paycheck.

Insurance You May Need: Disability Income Insurance

Disability income insurance can help protect your most important asset, your ability to earn an income, in case you were not able to work due to an illness or injury.

How It Works?

If you’re unable to work due to a covered sickness or injury, disability income insurance can pay up to 50-70% of your income. You can use the money in any way that you choose. You can the money to help cover your medical expenses, other bills or to pay someone to help with your recovery.

Next time you begin to imagine the what-ifs of life, use this information to put you at ease and help you to make the right decision when it comes to supplemental insurance.

(This guest post is written by Portia S from ‘Health Insurance Doesn’t Cover It’, which is a well-known supplemental health insurance educational site, focused on adding to the knowledge and safety of the public.)

1 Trackback / Pingback

Comments are closed.